GM friends and investors.

FTX, one of the largest crypto exchanges, filed for bankruptcy, and the latest inflation report came out from the US Bureau of Labor Statistics this week.

But more on that later.

On this day, in 1990, The World Wide Web was first proposed by CERN computer scientists Tim Berners-Lee and Robert Cailliau.

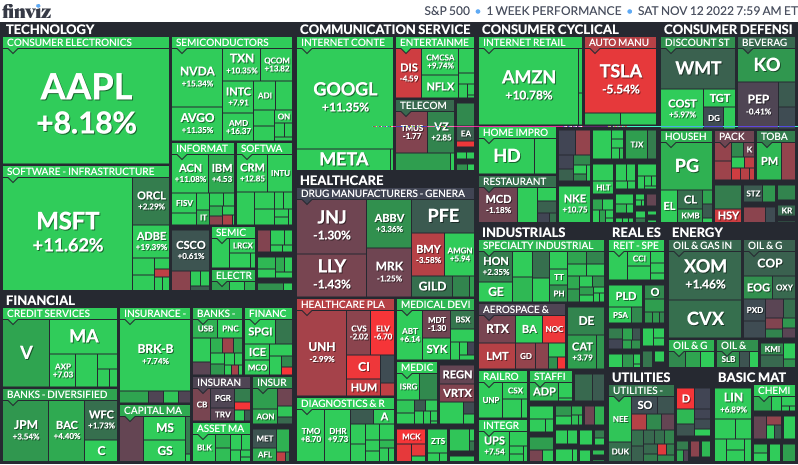

The S&P 500

The markets had their best two-day rally since March 2020. Stocks soared, and bond yields dropped after the latest inflation report showed better-than-expected results.

This gave hope to investors that the fed would finally start slowing the rise of interest rate increases.

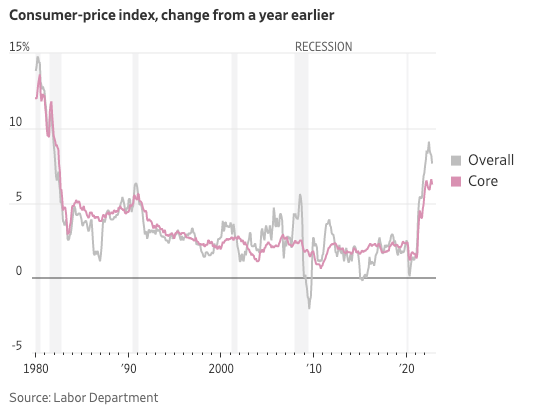

Inflation

Inflation eased to the slowest pace since January but still remains relatively high.

CPI increased 7.7% in October from the same month a year ago. That’s down from 8.2% in September and June’s rate of 9.1%, which was the highest in 4 decades.

Core CPI, which excludes volatile food and energy prices also down from 6.6% in September (the largest increase since August 1982) to 6.3% year over year.

Jerome Powell (chair of the Federal Reserve) said last week that strong consumer demand, a tight labor market, and stubborn price pressure could cause officials to raise rates higher than they anticipated in September.

The slowing of inflation gave investors hope that the target fed funds rate won’t have to be much higher than 5%.

Housing was a surprising contributor to inflation this month. Service costs have gone up because of the lessened demand.

Housing costs move slower because they are based on leases typically only negotiated once per year.

For those investors who love charts. Today’s issue is brought to you by:

A free newsletter where you can get interesting Data Stories narrated with charts & visuals on topics related to technology, businesses, and investing. Takes less than 2 mins to read!

Subscriber here → trendlinehq.com

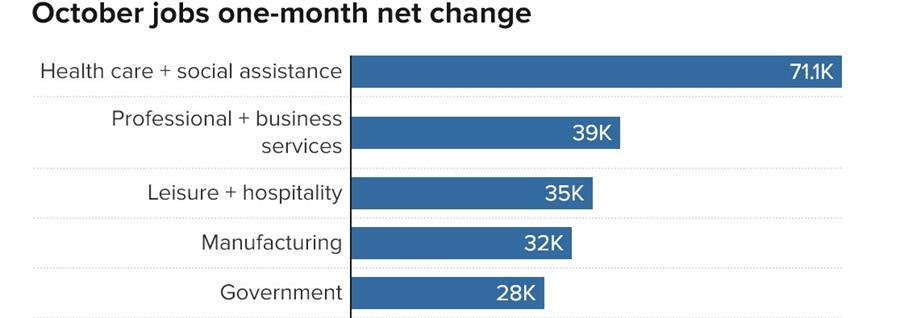

The Shaky State of the Job Market

October job growth was better than expected, showing gains, particularly in the manufacturing, healthcare, and business service sectors.

A manufacturing gain of 32,000 suggests the economy is far from slowing in a meaningful way, said TradeStation Group’s Group David Russel.

On the other side, The Tech Sector is in layoff mode.

Companies like. Meta, Lyft, Stripe, Chime, & Twitter are all beginning to decrease the size of their workforce.

Even mega-caps like Apple and Amazon are on a hiring freeze, showing that not all companies are immune to weekend consumer demand and higher interest rates.

The Downfall of FTX

If you haven’t heard by now, FTX, formerly led by Sam Bankman-Fried, filed for chapter 11 bankruptcy this week.

The crypto exchange lent billions of dollars of its customer assets to fund risky bets by its sister company Alameda Research setting them up for implosion.

Ex-CEO Mr.Bankman-Friend said in an investor meeting this week that Alameda owes FTX about $10B. Compared to the $16B total of customer assets, they lent over half.

FTX extended loans to Alameda using money customers had deposited in the exchange for trading purposes.

Mr.Bankman-Fried called this “a poor judgment call."

Binance, the largest crypto exchange in the world, was in negotiations to acquire FTX but stepped away from the deal after looking at its books.

Investors were shocked by not being able to pull money out of their accounts & it is unclear if customers will ever get their funds back.

That’s all for today! If you enjoyed this article, I only ask that you share it with a friend. It’s free : )