Good afternoon investors,

The stock is down today after a better-than-expected jobs report, leaving investors uncertain about the Fed’s next move.

Key Highlights.

Shocking July jobs report

HKD 0.00%↑ new meme stock?

Robinhood is shrinking

Crypto is the new wild west

A Strong Labor Market?

U.S. jobs report shows a gain of 528,000 in July.

Employment gains in July shocking expectations despite the Fed’s efforts to cool off the economy.

Most economists and forecasters expect the labor market to weaken as the monetary supply tightens to bring inflation under control.

The unemployment rate now sits at 3.5%, down from 3.6% in July.

This is a 50-year low in unemployment; the last time this happened was right before the outbreak in 2020.

Good news from president Biden and Fed chair Powell as they have stated we are not in a recession despite two consecutive quarters of negative economic growth.

Global Step Back

The Bank of England just raised interest rates by 50 basis points, the largest in over 25 years and the 6th consecutive rate hike.

The bank expects inflation to peak at 13.3% by the end of the fall and remain high throughout 2023. If everything goes well, they say their target of 2% inflation will be achieved by 2025.

China has been hit hard by a 30% decrease in property sales as it makes up a large portion of the country's revenue.

Evergrande (a Chinese real-estate company) failed to secure a $300 billion reconstruction plan, furthering the growing lack of confidence in the Chinese economy.

Stocks

The market has moved relatively sideways this week ahead of the Jobs report and uncertainty regarding the repercussions of Nancy Pelosi’s visit to Taiwan.

New meme stock?

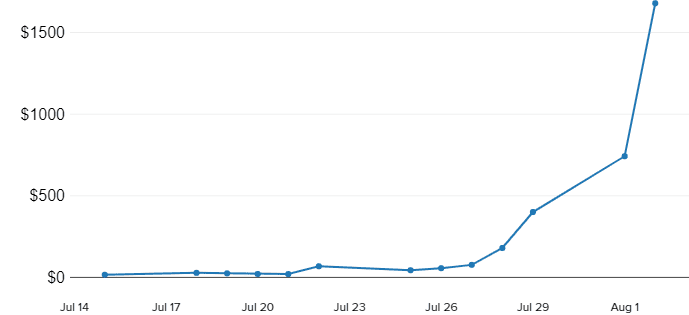

HKD 0.00%↑ AMTD Digital, a Hong Kong-based fintech company, is up over 10,000% since its IPO last month, reaching a market cap that parallels DIS 0.00%↑ Disney and META 0.00%↑ Meta Platforms.

Topping /wallstreetbets Reddit group recently.

Robinhood

The brokerage company reportedly cut 23% of its workforce only a few months after letting go 9% of its employees following dismal earnings.

Vlad Tenev, CEO of RobinHood, says this is due to many factors, such as ambitious hiring after the pandemic months, rising inflation, and a crypto bear market.

Other related stock news:

PYPL 0.00%↑ Paypal boomed on Wednesday after positive earnings leading NASDAQ higher.

UBER 0.00%↑ reported first positive cashflow earnings.

F 0.00%↑ Ford had its best month since 2008, gaining 32% in July.

Real-Estate

15-year 4.82%

30-year 5.57%

Mortgage rates Via Quicken Loans.

Foreclosures & rent

Real-estate foreclosures have been up more than 219% since the start of 2022. Major metro areas saw an increase of 86% in foreclosures. The highest rates are in Illinois, New Jersey, and Ohio.

Higher and higher interest rates have pushed new home buyers to opt for renting over buying. Largely due to the prime mortgage rates almost doubling since the start of rate hikes.

The average rent in the U.S. is now $2,495 per month, a 13.4% increase from a year ago.

Crypto

Crypto is the new wild west out there in the crypto space, and we want to make you’re covered.

Crypto Bridges have become an increasingly popular way for hackers to steal from investors by switching between different blockchains, making them difficult to track.

69% of all stolen crypto has been done through crypto bridges.

$2 billion has been stolen from these hacks all in all.

The SEC charged 11 people for taking over $300 million in a crypto Ponzi scheme.

On the bright side

COIN 0.00%↑ Coinbase is up big on the announcement of a partnership with Blackrock. The largest asset manager in the worldIt'st’s a move in the right direction after the company had to lay off 18% of its staff last month.

The company is currently under investigation by the SEC.

Even after the rally, the stock is still down around 70% on the year.

Share!

Thank you for reading The Money Matters Letter! Have a great week, and remember to live in the moment.

*NOTICE* Nothing said in this newsletter is financial advice. I am not a registered financial advisor; everyone should do their research before making investing decisions.

Investing has risks. You are not guaranteed to make money; you might even lose money. We care about your success.

This post is sponsored by no one.