Hello Friends,

Brace yourself if you haven’t checked the stock market in about six months. The market has been down ever since the federal reserve stopped quantitative easing. (or turned off the money printer, in simpler terms) With all of this inflation, rising interest rates, and higher commodity prices, most investors are predicting we are headed into a recession, and that’s because we are halfway there already.

Briefly, for anyone who doesn’t know:

A rececesion is a general decline in enconomic growth. Defined as two succesive quarters of negative GDP growth.

On April 28, the Bearueu of Economic Analysis reported that in Q1 of 2022, we realized a negative 1.4% decline in Gross Domestic Product. Fooling most economists who believed we would be at a positive 1.1% change. ( But they’re wrong most of the time anyway)

The Markets:

Year-to-date, the S&P 500 is down 16.63%. This is actually a historic event marking the worst first quarter since 1939, 83 years ago. Yet, no matter where you look, prices in any market are RED. Crypto is down nearing 40%, and according to @unusalwhales on Twitter (who identifies buying and selling pressure from data scraping and aggregation), the big players in the crypto market are still selling. Even in the Bond market, you see prices come down, and yields increase.

For the most part, BTC will follow the trajectory of the S&P, and right now, that is down. You might ask, well, why is Bitcoin down so much more than stocks? Well, Bitcoin and cryptos, in general, are deemed riskier assets, and when money becomes more expensive like it is right now, investors seek just not to lose money and have more of a risk-off approach to the markets.

Why is everything going down?

The Federal Reserve has one big tool in fighting inflation: The Federal Funds Rate. That is the rate at which banks can lend money to each other. If you didn’t know, Banks are required to keep a certain amount of cash on hand in case of emergencies. So when they aren’t meeting the requirement, they will borrow from another bank to satisfy their needs. The rate they can borrow at is controlled by the Federal Reserve.

This matters because the Federal Funds Rate is going up, making cash more expensive. After all, banks have to pay more to borrow. In turn, these lead to higher interest rate loans and mortgages. This also causes the cost of business to increase, which could lead to a spike in unemployment.

On May 4th, the FOMC raised rates by 50 basis points (0.5%) with a target of 3.0% by the end of the year.

This is the largest individual rate hike since 1989, causing fear and panic in the market.

Along with these rate hikes, the last FOMC meeting indicated they will start reducing their assets holdings on its $9 trillion dollar balance sheet. The fed has been buying bonds and mortgage-backed securities to keep the money flowing in the economy or be “accommodating” during the pandemic. But now they need to U-turn ( because of inflation) so they will essentially turn the money printer into a vacuum, decreasing the money supply.

All of this added up equals slower economic growth and a tightening money supply, which can explain why there has been so much pain in the market recently.

What can you do amid panic?

I am, of course, not a licensed financial advisor and this is not financial advice. But there is an interesting type of bond called the Series I Savings Bond, and it is currently yielding 9.6%. Given that inflation is a percent lower, it is seemingly not a bad investment guaranteeing you almost 10% on your money. Especially in times of economic uncertainty like we are in right now.

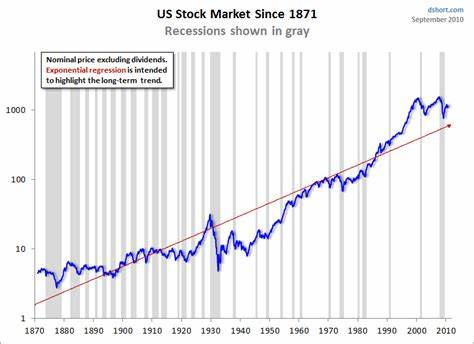

Of course, this is a temporary situation we are in. Of around the 30 recessions the United States has gone through, about half of them resulted in an increase in the S&P 500 at an average of 9%. If you aren’t too caught up in the day-to-day excitement of the stock market and the economy, I would only start getting concerned if you see some of your coworkers being laid off. ( indicating an unemployment spike)

If your time horizon is long enough, this upcoming recession is nothing to bat an eye at. Over the years, the S&P will continue to keep going up, and for most people, it’s not worth trying to time the market. The best thing you can do is invest a small portion of your income every week or month into the equity of your choice. This way, you’re not missing out ever, and you can feel confident in your investment goals while others are panicking.

Now I know there was a lot of technical jargon in today’s letter, and I will be sure to define some key terms in the glossary at the end of the article. But I hope you can make sense of this economic mess we are in. I’ll be posting some more about the current status of our economy and checking out some interesting leading & lagging indicators.

Have a great rest of your day, and live in the moment.

Follow us On Social Media!

Glossary for beginners:

GDP or Gross Domestic Product: The monetary measure of the market value of all final goods and services produced.

FOMC or Federal Open Market Committee: a collection of 12 members who meet 8 times a year to discuss the open markets and set interest rates.

Quantitive easing: the introduction of new money into the money supply by a central bank. Often by buying mortgage-backed securities, cooperate, and municipal bonds.

Commodities: A raw material or primary agricultural product that can be bought and sold like copper or coffee.