Good morning everyone!

A popular trend in personal finance is dividend investing. While I am a fan of the concept and the mostly stress-free lifestyle, it’s not for everyone. So today, I want to talk about a couple of nuances commonly overlooked by dividend bulls.

First, if you dont know what dividend investing is, I’ll explain it like this:

Investing in stocks that pay dividends (extra profits paid out to share holders) in order to recieve a consistent stream of income.

Now at first glance, it seems pretty great.

And for the most part, it is!

You put up capital with the expectation that you will get paid anywhere from 1-7%, depending on the stock, just for being a shareholder.

- Dividend yields can vary higher and lower than 1 and 7% (I just used those as examples )

-Dividend distribution schedule can vary.(quarter to quarter/month to month)

Over the years, the money you invest compounds and will build on each other, paying higher and higher dividends each year. That is, if you choose to reinvest dividends. (Which I definitely would if you would like to experience the miracle of compound interest)

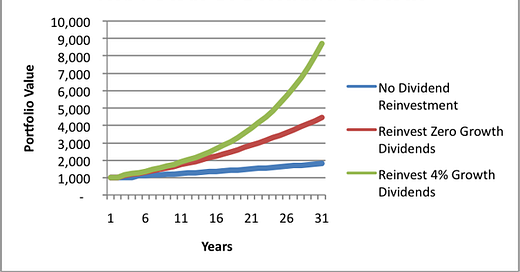

The chart above assumes the stock invested returns 5% annually.

-In 30 years $1,000 reaches $2,000 with no dividend Reinvestment.

-At the same time, with dividend reinvesting, the $1,000 investment reaches $4,000

-The green line assumes the company raises its dividend 4% each year, turning the $1,000 —> $9,000

Dividend Growth is fantastic when you consistently reinvest and let time & compounding do their thing. The problem is most of the growth happens after waiting for 20 years.

People that love dividend investing:

These people are patient, know that their time horizon is long, and typically don’t get scared in down markets. So you’ll still be getting paid every quarter even if the market is bearish. ( this is great for people who don’t want to check the market all the time but want to get the benefits)

Reasons why people don’t love dividend investing:

An ample counter to dividend investing is the missed opportunity in asset appreciation. ( however not applicable to all cases, i.e., Apple)

A company like Coca-Cola or Johnson & Johnson can consistently raise their dividends each year because they are not in the growth phase of their lifecycle. Instead, they have scaled to the point where they make so much cash that they pay back their shareholders more and more each year to keep them invested.

The issue here is that these companies have already grown and expanded so much that the stock value most likely won’t increase 740% in one year as Tesla did in 2020 ( a growth stock).

Now obviously, that’s an extreme example, but I’m choosing to use it to illustrate a point.

What should you do about it?

Well, my friend, that is up to you and the way you like to invest; everyone is different, and everyone gets peace of mind from different investing strategies. The Biggest nuance of dividend investing is time, but if you are okay with waiting, it seems to be a proven shot at significant results. On the other hand, if you’re less patient and strapped for time, we have a good understanding that dividend investing won’t give you the returns that a growth stock can occur early in its life.

The most reasonable thing to do is take one out of the lesson book from the Warren buffet and diversify. But again, you should invest in whatever helps you sleep at night; that way, you won’t be tempted to sell your investments when the market is down. (yes, the market will always come down sooner or later)

Well, friends, that’s a wrap on today’s post. I am aware that various other factors go into asset pricing and dividend yields. I just wanted to explain this concept to you without being weighed down in technical jargon.

Have a great day, and remember to be present :)